Richard L. Peterson, M.D.

(with data from SPANlab and Brian Knutson, PhD)

Founding Partner

Market Psychology Consulting

415.267.4880

rpeterson@marketpsych.com

Market

Psychology Consulting © 2004

Neuroscience and Investing: fMRI of the brain’s “reward system”

As you know, the brain is an extremely complex system. At the conclusion of eight years spent training in medicine, psychiatry, and neurology, I performed two years of research with neuroscientists at Stanford University. We studied the brain in-depth with fMRI scanners and pharmaceutical agents. The modern tools we use to investigate the delicate world of the brain are like the blunt stone-age instruments of our ancestors. The average human brain has 100 billion neurons with 100 trillion connections among them, and we neuroscience researchers have only just begun to gain a gross, simplified understanding of the structure of the brain and the mental life that arises within its mysterious workings.

Since the time of Aristotle in ancient Greece, scientists and philosophers have hypothesized the existence of two major motivational systems that drive almost all of our behavior. These two systems motivate our desire to pusue potential rewards and to avoid potential losses. They are the reward approach and the loss avoidance systems. When we, our customers, or our competitors perceive a potential gain in the environment, the brain’s ancient system of reward approach motivation is set into action. Scientists have shown that this “reward approach system” exists even in life forms as primitive as amoebas. It is the most basic motivator of activity in the brain, and potential gains appeal to it in specific ways.

The “reward approach system” is intricately linked to our experience of excitement, our ability to attend to something (attention), and our level of arousal. When people are ready to engage in reward approach, their behavior changes. They engage in greater risk-taking, experience positive feelings, and are more aroused. On the other hand, loss avoidance behavior is timid, protective, and risk averse. In business, reward approach behavior is outward-directed: consumer purchasing, investment activity, and borrowing on credit. Loss avoidance is seen in decreased borrowing, selling of assets, and the preference for less volatile investments. These behaviors, when exhibited by large groups, impact the economy as a whole.

From the perpective of neuroscientists, all behaviors arise in the brain as the result of anatomical, neurochemical, and electrical processes. With the new techniques of neuroimaging, we are able to visualize the origins of buying and selling behavior, consumer decision-making, and brand preference. Experimentally we are able to modify information in order to influence the buying and selling decisions of our research subjects. By this manner of systematic experimentation, we have discerned how potential gain dominates over other potential reward characteristics such as likelihood, time delay for results, and quality.

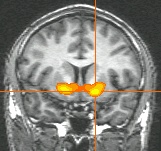

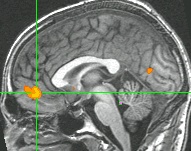

The reward system runs from the midbrain (the “reptilian brain”) through the limbic system (the “emotional brain”) and ends in the neocortex (the brain’s center of “executive function”). The neurons that carry information between these brain regions in the reward system are called dopaminergic neurons – that is, they predominantly carry the neurotransmitter dopamine. Dopamine has been called the “pleasure” chemical of the brain, because people who are electrically stimulated in the limbic dopaminergic centers of the brain report intense feelings of well-being and sometimes orgasm. In the following graphic, the ventraltegmental area (VTA) is the origin of the dopaminergic neurons, the nucleus accumbens (NACC) is the “pleasure center,” and the medial prefrontal cortex (MPFC) is the thinking, neocortical part of the brain.

|

|

This reward system can be visualized with functional magnetic resonance imaging (fMRI) as experimental subjects are presented items that they may find rewarding on a computer screen. The fMRI machine is pictured above. Several experimental stimuli have been found to activate the brain’s reward system. These activating substances and images include chocolate, pictures of attractive people, money, sweet foods and drinks, and even pictures of sports cars for men and luxury brands for women. Anticipation of getting the desired object activates the NACC, while receiving or enjoying the image or substance itself activates the MPFC. In experimental parlance, anticipation of reward activates the NACC while reward outcomes activate the MPFC.

It has recently been found that seeing a preferred brand of coffee, beer, soda, or magazine alongside a non-preferred brand activates the MPFC when the preferred brand is recognized. These findings with brands are the impetus for the development of the business of “neuromarketing.” In our experiments we use money as a prototypical reward. Money is rewarding and desired by everyone, and it is easy to manipulate in terms of time delay, size, and probability (although we still haven’t found a way to reliably manipulate perceptions of quality). The MPFC is activated by receiving money, while the NACC is activated while anticipating a chance to get money. See below.

|

|

|

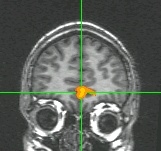

The nucleus accumbens (NACC) is activated when a monetary, chocolate, sexual, luxury, or other reward is anticipated. |

|

|

|

The medial prefrontal cortex (MPFC) is activated when a preferred brand is seen, when a loved one is imagined, or when a reward is received. |

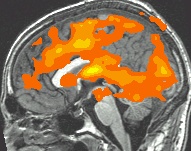

The reward system is displayed in the images above a few seconds after a reward is presented or received. However, when the same filter is used on all the data, at a much lower threshold, we can see activations in much of the brain. The best way to visualize the power of reward magnitude is to observe it juxtaposed against equivalent probability and expected utility manipulations in the following whole-brain cross-sectional (sagittal) images.

The first image represents the power of reward “size” in activating the brain, the second image represents the power of reward probability in activating the brain, and the third image represents the power of both reward and probability together (expected value) in activating the brain, orthogonally. As you can see, overall the brain is much more responsive to changes in gain size than to equivalent changes in probability. In each case the difference portrayed is in an expected gain of $3. The difference is represented either directly in terms of cash ($3 difference), probability (also a $3 difference - 80% chance of $5 versus a 20% chance of $5), or the product of both manipulations (expected value difference of $3). In the images, the colors are not relevant to the results.

|

|

|

|

|

The impact of a potential reward in magnitude (size) terms. This may be why people play the lottery (big reward). |

The impact of a potential reward in probability terms. This may be why people have trouble distinguishing middle range probabilities from each other. |

The impact of a potential reward in expected value (magnitude*probability) terms. This may be why people have trouble planning for the future, including retirement investment. |

As you can see, neuroscience is making enormous strides in understanding how the mind of the market really works. Reward system activation correlates with subjective feelings of pleasure, physiological arousal, and behavioral impulsivity. One Austrian researcher found that arousal similarly correlates with a greater willingness to spend money while shopping. Others have found that the emotions of investors correlate with the future stock market direction. Again, all of these findings are rooted in the brain. As of yet, there is no sure way to predict consumer or investor behavior based on this research. There are interesting and important correlations that will be included in further articles.

I have presented findings here on the nature of the brain’s reward system and the impact of the SIZE of a potential gain on the brain. There are additional fascinating findings on the loss avoidance system, the brain’s emotional life, and the process of brand recognition and attachment where science is making rapid strides in understanding. This research is still in its infancy, and the possible new directions it may take are too many to forecast.

Market

Psychology Consulting © 2004